tax planning services introduction

While creating your tax preparation business plan you must include the detail about how you will be able to provide the optimal and efficient services to meet all the clients. Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management.

How To Become A Tax Consultant

Tax planning services introduction Monday April 18 2022 Edit.

/two-business-people-calculate-their-business-in-the-office--918789230-5dfe7ee1921b4b74a28798a8f5c2e762.jpg)

. Ad Reduce Risk Drive Efficiency. Tax planning is the analysis and arrangement of a persons financial situation in order to maximize tax breaks and minimize tax liabilities in a legal and efficient manner. Chances of lower tax brackets in the future.

While you can always pay your taxes. Tax Planning and ManagementTax Planning Management Basic ConceptsIntroduction to Tax PlanningTaxTypes of Taxes Lecture 1Learning objec. INTRODUCTION TO TAX PLANNING AND MANAGEMENT Taxes are the compulsory contribution by the citizens of a country for meeting different government expenditures.

Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services. Tax planning is one of those things we all say we do.

Topics COVID-19 Accounting Audit Firm Management Payroll Small Business Tax Reviews Product Service. Idama Tax Preparation Inc. Ad A good tax preparer will help simplify your filing and make sure its done right.

The avid goal of every taxpayer is to minimize his Tax Liability. The first step includes understanding your total income from all sources. Tax planning is a focal part of financial planning.

If you are employed it would be. There are two main inventory. Tax planning is a legal way of.

Tax planning is the process of optimizing and reducing your tax liability through various strategies. Strengthen internal controls and improve quality with the latest tax automation software. A tax planning accountant can advise how and when to buy inventory to create the most of deductions and alterations in stock value valuation.

Basic steps to plan taxes. See it in Action. Request Your Demo Today.

Avalara calculates collects files remits sales tax returns for your business. It ensures savings on taxes while simultaneously conforming to the legal obligations and requirements of the Income Tax Act. A tax planning advisorfinancial consultant can help you understand how each investment contributes toward financial goals such as.

Meaning Method of Tax Planning. Would provide services such as income tax. Identify the federal state and.

It can include a number of services. The Basics of Tax Planning. Tax preparation services is all about helping individuals and small businesses provide income tax compilation services income tax return preparation services and other tax return preparation.

Tax planning refers to financial planning for tax efficiency. It aims to reduce ones tax liabilities and optimally utilize tax exemptions tax rebates and benefits as much as. Ad Build an Effective Tax and Finance Function with a Range of Transformative Services.

Idama Tax Preparation Inc. Identify the federal state and. Ad Reduce Risk Drive Efficiency.

Ad From Fisher Investments 40 years managing money and helping thousands of families. Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc. See it In Action.

See it In Action. We have high standards and only recommend professionals with a track record of success. Ad End-to-End tax support from tax coding return filing tax audit and knowledge management.

After completing this training you will be ableto. Ad Avalara AvaTax Lowers Risk by Automating Sales Tax Compliance. If you dont start making decisions that can.

Understand your gross annual income. Cant pay entire tax burden. Tax planning is the logical analysis of a financial position from a tax perspective.

Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and. Steps for Tax Planning. TAX PLANNING AND REPORTING.

Postponing taxes is still an important tax-saving technique of Tax Planning. Heres a sampling of the services we offer. Request Your Demo Today.

To achieve this objective taxpayer may resort to following Three. Is a financial services industry licensed and registered and is to be located in Miami USA. TAX PLANNING AND REPORTING.

Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management. Tax planning allows a taxpayer to make the best use of the various tax exemptions deductions and benefits to minimize their tax liability over a financial year. Most people do their taxes in March or April when the deadline for filing tax returns is approaching.

Private Wealth Tax Planning Pwc Channel Islands

Tax Planning For High Net Worth Individuals Bmo Private Wealth

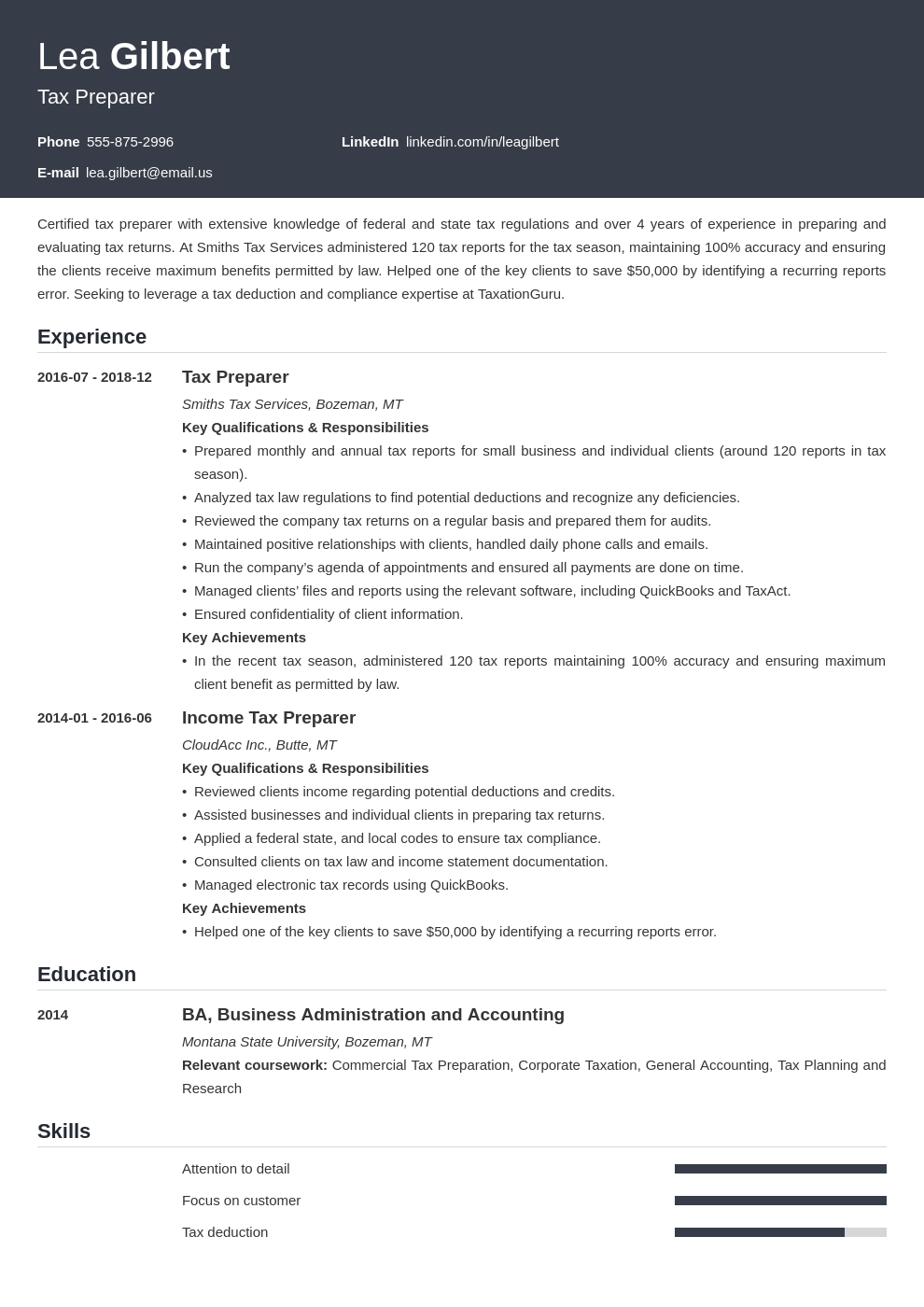

Tax Preparer Resume Sample Writing Guide 20 Tips

Tax Planning Meaning Importance It S Benefits Edelweiss Mf

Tax Planning Everything You Need To Know Ipleaders

Indian Tax System Taxation Structure In India Current Policies Explainedaegon Life Blog Read All About Insurance Investing

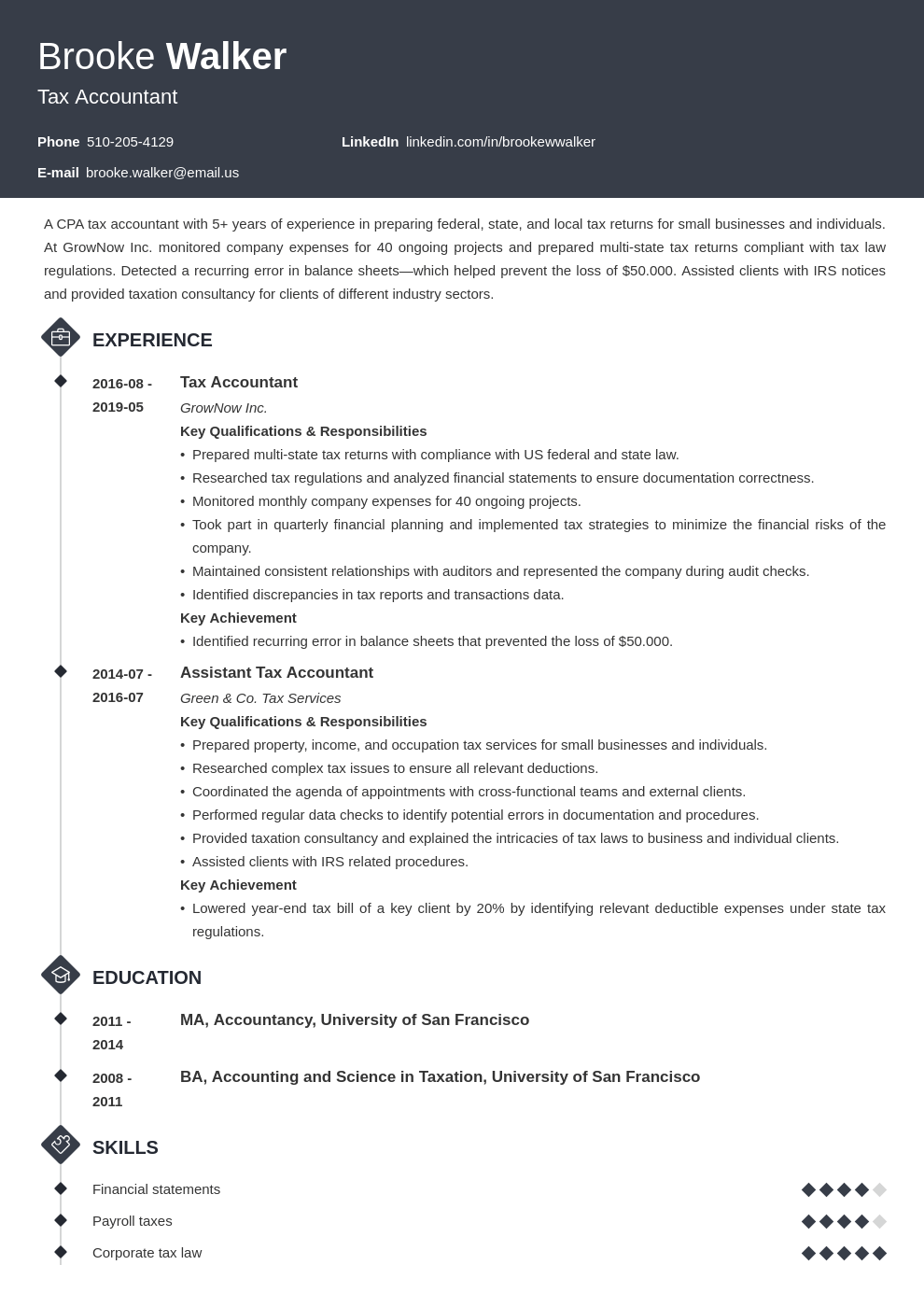

Tax Accountant Resume Sample Guide 20 Tips

/GettyImages-936538294-c7bc85f4feda496b97d7c52b2d6f799d.jpg)

Introduction To Accounting Information Systems Ais

What Makes Tax Planning Important Central Bank

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Tax Preparation In Pasadena Md Tax Preparation Bookkeeping Services Pasadena

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Moss Adams Accounting Consulting Wealth Management

Difference Between Tax Planning And Tax Management With Table Ask Any Difference

/taxes_83402612-5bfc357546e0fb005146b209.jpg)

2 Ways Hedge Funds Avoid Paying Taxes

/GettyImages-1086691530-d383bde425ae4d8abe8d5319b0bdbcc7.jpg)

:max_bytes(150000):strip_icc()/GettyImages-CA21828-6efa3d1061f04e47b23487ce9917a985.jpg)