working capital turnover ratio interpretation

Working capital turnover ratio revenue from operationworking capital. Click to see full answer.

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio is an efficiency ratio that measures the efficiency with which a company is using its working capital in order to support the sales and help in the growth of the business.

. We calculate it by dividing revenue by the average working capital. A companys working capital ratio is a measure of its short-term ability to cover its financial liabilities. How do you interpret working capital turnover ratio.

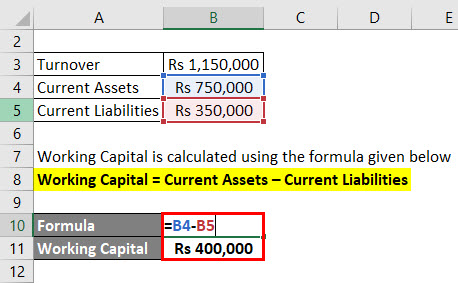

Working capital ratio is found through the formula. Working capital is current assets minus current liabilities. Where cost of sales Opening stock Net purchases Direct expends - Closing stock.

It is defined as the difference between the current assets and current liabilities and working capital turnover ratio establishes. Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period. The working capital turnover ratio shows the companys ability to pay its current liabilities with its current assets.

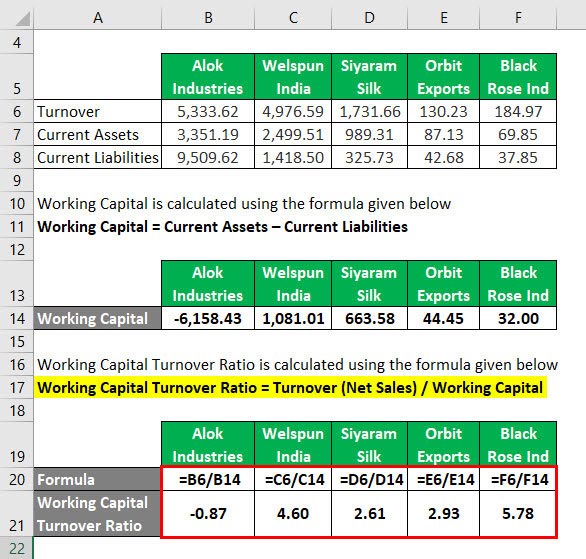

Capital turnover is the measure that indicates organizations efficiency in relation to the utilization of capital employed in the business and it is calculated as a ratio of total annual turnover divided by the total amount of stockholders equity also known as net worth and the higher the ratio the better is the utilization of capital. Take the Next Step to Invest. Working capital turnover ratio Net Sales Average working capital 514405 -17219 -299x.

Working Capital Turnover Ratio 288. The working capital turnover ratio shows the connection between the money used to finance business operations and the revenue a business earns as. Generally if the Working Capital Ratio is 1 it entails the company is not at risk and can survive once the liabilities are paid.

A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities to support sales. Working capital turnover Net annual sales Working capital. The working capital turnover ratio equals net sales for the year -- or sales minus refunds and discounts -- divided by average working capital.

In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. The working capital turnover ratio is thus 12000000 2000000 60. The working capital turnover is a ratio to quantify the proportion of net sales to working capital.

Working Capital Turnover Ratio Formula. This template helps you to calculate the ratio easily. We now look at the meaning and characteristics of working capital turnover ratio as mentioned in the chapter on accounting ratios class 12.

The main purpose of calculating this ratio is that a firm may like to relate net current assets to sales. Working Capital Turnover Ratio. Average working capital equals working capital at the beginning of the year plus working capital at year-end divided by 2.

Net Sales Average Working Capital 100. Working Capital Turnover Ratio is a financial ratio which shows how efficiently a company is utilizing its working capital to generate revenue. Working capital is the asset base after taking into account liabilities.

Interpretation Analysis. However if the information regarding cost of sales and opening balance of. Working capital turnover ratio class 12.

It signifies that how well a company is generating its sales with respect to the working capital of the company. Working capital turnover ratio Cost of sales Average net working capital. The formula consists of two components net sales and average working capital.

Generally a working capital ratio of less than one is taken as indicative of potential future liquidity problems while a ratio of 15 to two is interpreted as indicating a company on solid. It can also be found with the formula. Working capital is very essential for the business.

Working Capital Turnover ratio is computed by dividing sales by the net working capital. A higher ratio indicates higher operating efficiency where every dollar of working capital generates more revenue. The ratio is very.

The working capital of a company is the difference between the current assets and current liabilities of a company. Working capital turnover is a financial ratio to measure how efficiently companies use their working capital to generate revenue. Working Capital Turnover Ratio Turnover Net Sales Working Capital.

The formula for calculating this ratio is by dividing the sales of the company by the working capital of the. For a firm to maintain Working Capital Ratio higher than 1 they need to analyze the current assets and liabilities efficiently. Net working capital is the excess of current assets over current liabilities.

Ratio basically indicates what amount of net working capital is used for making one rupee of sales. The Working Capital Turnover Ratio is also called Net Sales to Working Capital. This means that every dollar of working capital produces 6 in revenue.

To understand more about this topic in greater depth visit Working Capital Turnover Ratio formula and interpretation. Working capital turnover ratio interpretation. It is a relationship between working capital and revenue from operations.

This ratio tries to build a relationship between the companys Revenue and Working Capital. Working capital turnover ratio is computed by dividing the net sales by average working capital. Average of networking capital is calculated as usual opening closing dividing by 2.

If the previous year ratio was higher than 389 this would suggest that utilization of the working capital during the period has become inefficient or rather less efficient than before. Net working capital Current assets - Current liabilities. It measures how efficiently a business turns its working capital into increase sales.

Current cash assets divided by current liabilities. This ratio shows the relationship between the funds used to finance the companys operations and the revenues a company generates in return. What this means is that Walmart was able to generate Revenue in spite of having negative working capital.

Working capital turnover also known as net sales to working capital is an efficiency ratio used to measure how the company is using its working capital to support a given level of sales. It shows companys efficiency in generating sales revenue using total working capital available in the business during a particular period of time. The formula for this ratio is.

As clearly evident Walmart has a negative Working capital turnover ratio of -299 times. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2.

As a standalone figure this is without context and you would need to compare it to previous year figures. Though it doesnt conclude the company is doing great it is just a neutral state.

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio Formula And Excel Calculator

Capital Turnover Definition Formula Calculation

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Dr Marie Bani Khalid Dr Mari E Banikhaled Ppt Download

Working Capital Turnover Ratio Ratio Interpretation Financial Ratio

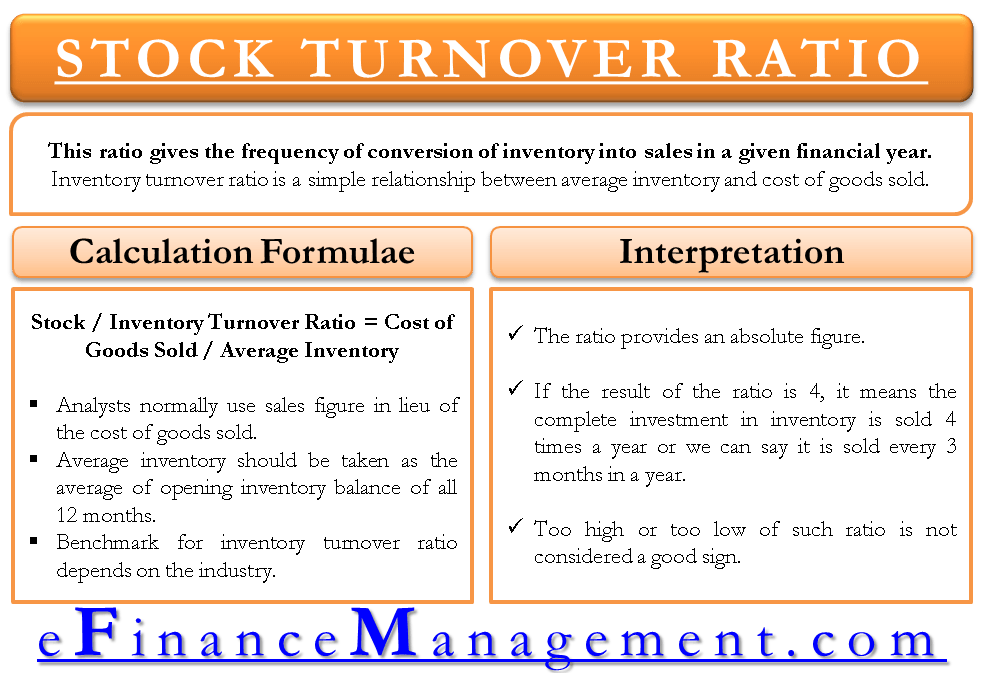

Stock Inventory Turnover Ratio Calculate Formula Benchmark

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Different Examples With Advantages